Arjun Mehta

December 9, 2024

Smart capital deployment is more than financial planning—it's a strategic imperative in today's dynamic economy. By aligning capital with data-driven insights, technological innovation, workforce development, and ESG priorities, businesses can unlock sustainable growth and competitive advantage. From predictive analytics and cloud platforms to ecosystem partnerships and adaptive budgeting, capital must be invested with clarity, agility, and long-term vision. In this Capital Intelligence Era, success belongs to those who treat capital as a lever for transformation—not just expenditure.

In today’s hyper-competitive and fast-evolving global economy, how a business allocates its capital can make or break its future. It’s no longer just about funding the next project or cutting costs—smart capital deployment involves a strategic approach to investing in technologies, capabilities, and partnerships that deliver long-term growth, operational efficiency, and sustainable impact. For investors and business leaders alike, the real question has become: how do you make capital work smarter, not just harder?

Capital deployment is not a new concept. Businesses have always had to decide where to allocate financial resources—whether toward operations, innovation, acquisitions, or workforce expansion. However, the "smart" in smart capital deployment refers to the use of data-driven insights, future-focused strategy, and dynamic market alignment in making these decisions.

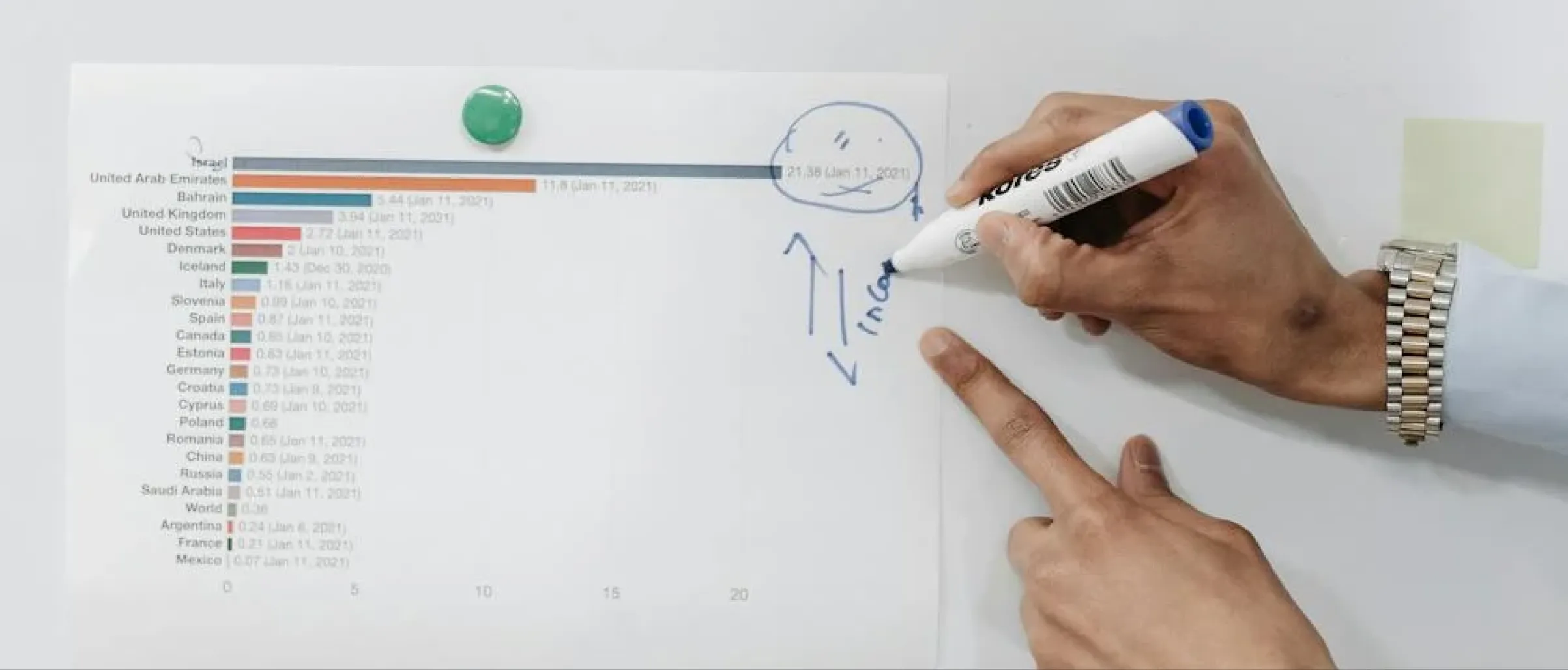

Modern businesses now lean heavily on data for decision-making. Capital allocation decisions that were once made based on experience or intuition are now increasingly modeled through simulations, scenario planning, and predictive algorithms.

Companies like Amazon and Alphabet (Google) have excelled in deploying capital through intelligent reinvestment into cloud infrastructure, R&D, and M&A strategies that bolster their ecosystem. Their ability to identify high-leverage opportunities early—backed by data analytics—has become the benchmark.

Case Insight: According to a 2023 McKinsey report, companies that apply data-driven capital strategies have a 12% higher average annual growth rate compared to those using traditional approaches.

Smart capital deployment often translates to investing in innovation:

AI and Automation: Deploying funds into intelligent systems that reduce operational inefficiencies.

Cloud Computing: Building scalable tech architecture.

Digital Platforms: Creating new revenue channels (e.g., subscription models, APIs, SaaS platforms).

While tech gets much of the spotlight, human capital is equally crucial. Smart capital deployment should include strategic investment in people:

According to PwC, companies investing more than 10% of capital expenditure in workforce development see a 25% improvement in productivity over five years.

Each industry demands a unique lens:

Healthcare & Pharma: Focus on R&D, compliance, and digital patient engagement platforms.

Retail: Investment in omnichannel tech, personalization, and logistics.

Manufacturing: Automation, digital twins, and supply chain transparency.

Example: Tesla’s decision to vertically integrate production—while costly upfront—has allowed it greater control, better margins, and rapid scale.

Today’s capital decisions are also scrutinized through an ESG (Environmental, Social, and Governance) lens. Investors and partners are asking:

Is the capital used sustainably?

Are you funding inclusive innovation?

Does it align with regulatory and environmental expectations?

Smart capital deployment often means balancing profit with purpose. A company that deploys capital to upgrade facilities for greener output is not just improving its ESG score—it’s future-proofing itself.

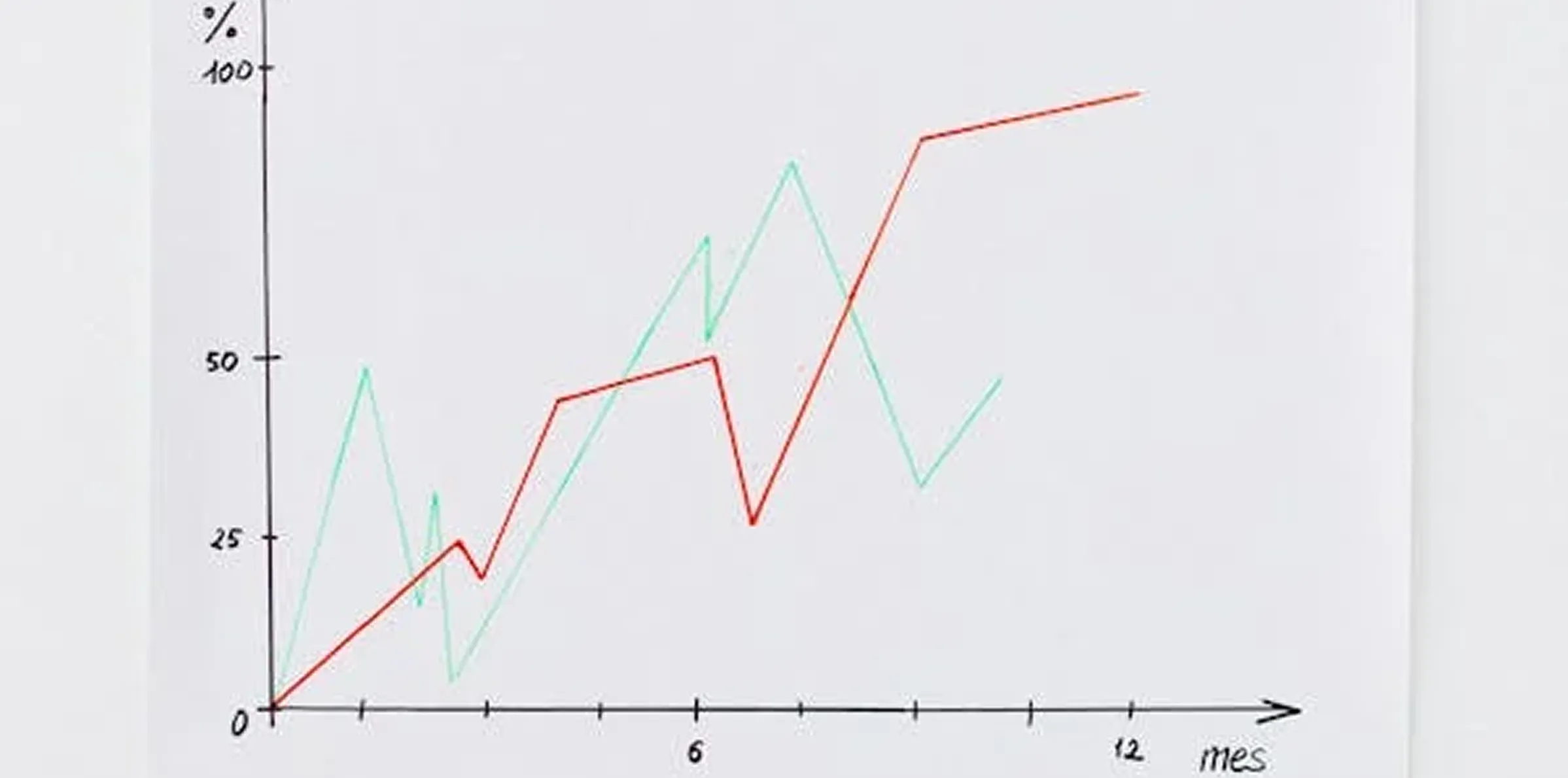

Strategic capital deployment must come with clear metrics:

Analytics dashboards and performance reviews help ensure that capital allocation stays dynamic rather than static.

Ineffective capital use often results in:

Case Warning: WeWork’s over-capitalization and rapid expansion without matching operational alignment is a cautionary tale.

Sometimes, the smartest move is to partner. Companies are increasingly using capital to build or join ecosystems rather than go solo. Partnering with firms like GrowQ 360 or vertical specialists helps:

As businesses face new economic models (Web3, decentralized finance, AI agents), capital deployment must also evolve. We are entering the Capital Intelligence Era:

Real-time tracking of capital flows.

Adaptive capital budgeting using AI.

Tokenized investment and DeFi platforms.

Smart capital deployment is not a tactic—it’s a strategic philosophy. Businesses must ask: Are we investing in growth, resilience, and long-term value, or are we simply spending? In the new economy, growth isn’t just about having capital—it’s about deploying it with clarity, agility, and vision.